16 Feb Hammer (candlestick Pattern)

Contents

The “More Data” widgets are also available from the Links column of the right side of the data table. Switch the View to “Weekly” to see symbols where the pattern will appear on a Weekly chart. Master excel formulas, graphs, shortcuts with 3+hrs of Video. I accept Client Agreement/Terms and Conditions and all risks related to trading operations.

Especially when using intraday strategies, one of the most popular moving averages is the EMA because it can react to price changes faster. The bullish inverted hammer is usually green, and you should find it at the end of a downtrend. Most traders will wait until the day after a Hammer pattern forms to see if a rally continues or if there are other indications like a break of a downward trendline. There was so much support and subsequent buying pressure, that prices were able to close the day even higher than the open, a very bullish sign. Chart 2 shows that the market began the day testing to find where demand would enter the market.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

It shows that the sellers have lost momentum and buyers are interested in pushing the price up. The pattern is widely used by traders to identify the beginning of a potential uptrend in the market and enter long positions. Umbrellas can be either bullish or bearish depending on where they appear in a trend. The latter’s ominous name is derived from its look of a hanging man with dangling legs.

Using the Hammer Candlestick Pattern in Trend Reversal Trading

After few such https://bigbostrade.com/-colored candles, the hammer appears which has a small body formed of open and close prices, but a very long lower wick. It indicates that the price went to pretty low value, but rebounded from there to near around the open price. The confirmation candle which should be green in color – that is, a bullish candle – will further support this premise, and longer this confirmation candle the better. It will mean that buyers are now taking charge of the market prices and outpacing the sellers.

It has formed a bullish hammer which as per the pattern suggests the trader to go long on the stock. In fact the same chapter section 7.2 discusses this pattern in detail. The risk-averse trader would have saved himself from a loss-making trade on the first hammer, thanks to Rule 1 of candlesticks. However, the second hammer would have enticed both the risk-averse and risk-taker to enter a trade. After initiating the trade, the stock did not move up; it stayed nearly flat and cracked down eventually.

Is an Inverted Hammer bullish or bearish?

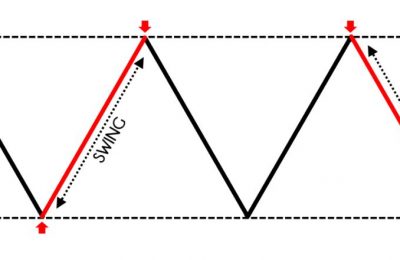

The ABCD patternOne of the most classic chart patterns, the Forex ABCD pattern represents the perfect harmony between price and time. How to Use DeMarker Indicator For Forex TradingEvery trader needs to know precisely when to enter or exit a forex market. How to Trade With The On Balance Volume IndicatorThe On Balance Volume indicator analyses the forex price momentum to measure the market’s buying and selling pressure. Candlestick chart created using Plotly demonstrating the positions of the inverted hammer.

It is constructed on the price charts during the downtrend, and must have a lower long wick which must be at least twice the size of the body. The body is constituted by the open and close prices, while the lower wick is the portion driven by the low price. To ensure longer size of the lower wick, the lower the value of the low price the better. Upper wick should not be there, or should be of relatively insignificant length. A gap that may exist at the opening and closing adds to the strength of the signal and bolsters the chances of price reversal.

- Ideally, the lower wick should not exist at all, or at the most have a very negligible length.

- You can find an example of the entry at significant support in the picture below.

- This material has been prepared using the thoughts and opinions of the author and these may change.

- Following the formation of this pattern, the price declined, reaching a local bottom, where bullish hammer patterns had already been formed.

- A hammer candlestick has all three of these characteristics.

A protective Stop Loss should be placed below the Hammer’s low or at the opening or closing price of the candle’s real body. During a downtrend, the sellers are in control of the market and have beaten the buyers . It means that the buyers are now attempting to match the sellers. This state indicates indecision that has developed amid ongoing downtrend, and hence there is a good possibility that prices may rebound to move upwards. The confirmation candle which should be green in color – that is, a bullish candle – will further support the move. The longer this confirmation candle the higher the chance of a continued up move.

How is an inverted hammer candlestick formed?

The hammer should have no upper shadow, but can have an upper shadow if it is relatively small. A hammer experiences failure when a new high price is visible just after the closing and the bottom part of the hammer fails when the next candle reaches a new low price in the trend. The list of symbols included on the page is updated every 10 minutes throughout the trading day. However, new stocks are not automatically added to or re-ranked on the page until the site performs its 10-minute update. The Bearish Gartley PatternThe Bearish Gartley pattern was introduced in 1935, by H.M. The pattern helps Forex traders in identifying higher probabilities of selling opportunities.

How to https://forexarticles.net/ the hammer candlestick pattern As stated earlier, a hammer is a bullish reversal pattern. It occurs at the end of a downtrend when the bears start losing their dominance. In the chart below, we see a GBP/USD daily chart where the price action moves lower up to the point where it prints a fresh short term low. The Hanging Man is a bearish signal that appears in an uptrend and warns of a potential trend reversal. The candlestick pattern is called the Hanging Man because the candlestick resembles a Hanging Man with dangling legs. For this reason, confirmation of a trend reversal is should be sought.

https://forex-world.net/rs often use a combination of several indicators, price patterns, and different candlesticks to interpret current market conditions and check whether the trade will be profitable or not. Between 74%-89% of retail investor accounts lose money when trading CFDs. 76% of retail investor accounts lose money when trading CFDs with this provider. Also, note that a hammer pattern with a very narrow body can look like a Dragonfly Doji. A bullish hammer, positioned for example, at a support level or after bearish candles, has a small body at the top of the candle and a long wick beneath the body.

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. The default “Intraday” page shows patterns detected using delayed intraday data. It includes a column that indicates whether the same candle pattern is detected using weekly data. Candle patterns that appear on the Intradaay page and the Weekly page are stronger indicators of the candlestick pattern.

A long shadow shoots higher, while the close, open, and low are all registered near the same level. Both are reversal patterns, and they occur at the bottom of a downtrend. Confirmation came on the next candle, which gapped higher and then saw the price get bid up to a close well above the closing price of the hammer. As usual, the hammer should represent a reversal signal – in this case, the beginning of a new uptrend.

Construction of the Inverted Hammer Candlestick Chart Pattern

It is supposed to act as a bullish reversal and testing reveals that it does 60% of the time, placing the reversal rank at 26. Once price reverses, though, it does not travel far based on the overall performance rank of 65 where 1 is best out of 103 candle types. The hammer and hanging man candlesticks are similar in appearance, and both patterns signal trend reversals. That said, one can find these two candles in different trends.

The shooting star is a bearish pattern; hence the prior trend should be bullish. The hammer pattern is a single-candle bullish reversal pattern that can be spotted at the end of a downtrend. The opening price, close, and top are approximately at the same price, while there is a long wick that extends lower, twice as big as the short body.

Sorry, the comment form is closed at this time.