24 Jul 8 Types of Accounting Concepts: Example and Explanation

Contents

The header will identify the last date of the accounting period, for example, “as of June 30, 20XX.” The financial statements published at the end of every accounting period are significant for the stakeholders, investors, creditors, and government agencies. This data provides the stakeholders with relevant and reliable data that can be employed to make crucial decisions.

This means that many important transfers which do not include money are not noted in the accounts book of the business. This concept also requires that a business also put a monetary value on its intangible assets such as brand name or intellectual property. For example, a business may choose a fiscal year from Feb. 1 to Jan. 31 or observe a week fiscal year, where each year rotates between being 52 or 53 weeks long. If a business wants to select the fiscal year for tax reporting, they can do so by submitting their first income tax return observing that tax year. The accounting period usually coincides with the business’ fiscal year.

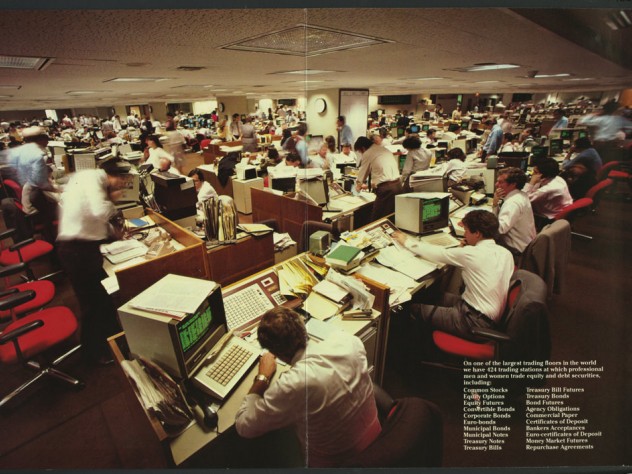

- The continuous stream of trading events can be optionally divided into phases.

- For example, On March 5, 2021, the firm sold goods for Rs 55000, and the payment was not received until April 5, 2021, the amount was due and payable to the firm on the date goods and services were sold i.e.

- This is an important assumption of accounting as it provides a base for representing the asset value in the balance sheet.

- The accounting period usually coincides with the business’ fiscal year.

Accounting periods are established for reporting and analysis purposes. In theory, an entity hopes to experience consistency in growth across accounting periods account period concept to display stability and an outlook of long-term profitability. The method of accounting that supports this theory is the accrual method of accounting.

Businesses must prepare financial statements before the start of the next accounting period to complete this cycle. To ensure that there is a reliable and comparable set of financial statements, the performance and position of a business are measured at the end of the accounting periods. A business firm gathers and keeps track of its financial transactions through the course of an accounting period. The data acquired as a consequence is used to create and publish financial statements at the culmination of the accounting period. Accounting conventions are certain restrictions for the business transactions that are complicated and are unclear.

The Difference between an Accounting Period and a Financial Year

For example, the plant and machinery was purchased by a company of Rs. 10 lakhs and its life span is 10 years. According to the Going concept, every year some amount of assets purchased by the business will be represented as an expense and the balance amount will be shown as an asset in the books of accounts. The accounting cost concept states all the business assets should be written down in the book of accounts at the price assets are purchased, including the cost of acquisition, and installation. It implies that the fixed assets like plant and machinery, building, furniture, etc are recorded at their purchase price. For example, a machine was purchased by ABC Limited for Rs.10,00,000, for manufacturing bottles. An amount of Rs.2,000 was spent on transporting the machine to the factory site.

At the end of the accounting period, the accounting cycle is used to compile financial statements. The accounting period is the length of time it takes for a business’s accounting cycle to be completed. Because the accounting cycle captures all transactions across time and reports them in the form of financials, one accounting cycle equals one accounting period. The cycle starts with the financial books at the start of each financial period with reversing entries and ends with year-end closing entries at the end of that period.

Hence, the total amount at which the machine will be recorded in the books of accounts would be the total of all these items i.e. The results of each interval will represent the company’s financial result in each such interval. Thus, the one-by-one comparison is possible only regarding the accounting period. Whether a company has incurred losses or profits is a vague question if any fixed interval is not allotted.

Accounting concepts act as an underlying principle that helps accountants in the preparation and maintenance of business records. The continuous stream of trading events can be optionally divided into phases. Because business activities do not cease or drastically change when one accounting period finishes and another begins.

Accounting period and fiscal year

A business can have as many accounting periods as it needs to, provided it complies with all its legal requirements. Companies need to choose their accounting periods intelligently and should not change them unless circumstances require such changes. All linked accounting transactions must be recorded in the same period, and mandatory accounting rules must be established to avoid violating matching principles. The corporation compiles and arranges its financial activity during the accounting period.

In contrast to the comprehensive view of spending when an item is paid, this payment identification allows for relative comparisons over several billing periods. According to the going concern idea, the company will continue to operate indefinitely. So, according to the accounting period concept, Ram & Sons prepares their accounts once a year, with the year beginning on April 1 and ending on March 31.

It means the cash balance of M/s Independent Trading Company will increase by a sum of Rs 2,000,000/-. At the same time, the liability of M/s Independent Trading Company in the form of capital will also increase. It means M/s Independent Trading Company is liable to pay Rs 2,000,000 https://1investing.in/ to Mr A. According to this concept, the business and the owner of the business are two different entities. Practically, it will be correct to say that the entity will record the realized value of the asset once the asset has been sold or disposed of off, as the case may be.

What is the Significance of an Accounting Period?

Therefore, the business entity concept states that the business and the business owner are two separate/distinct persons. Accordingly, any expenses incurred by the owner for himself or his family from business will be considered as expenses and it will be represented as drawings. Generally speaking, an accounting period is a predetermined period of the accounting activities, data is accumulated, and analysis is undertaken, such as a calendar year or fiscal year, among other things.

This information is quite important for business owners, investors, creditors and government agencies. The time period assumption provides the stakeholders with reliable and relevant financial information to make their reliable business decisions in a timely manner. The calculation of the accounting period is important as this forms the base for the investors to invest in a particular business.

In the U.S., some companies have annual accounting periods that end on dates other than December 31. For example, a company could have a fiscal year of July 1 through the following June 30. Its quarterly accounting periods would be July 1 through September 30, etc. The fiscal year refers to an annual period that does not end on December 31.

Accounting Period: What It Is, How It Works, Types, Requirements

The accounting period concept refers to the division of accounts records into similar multiple measured times. The performance of the company is measured and then disclosed to the investors in regular time periods. The fact that financial statements are prepared according to accounting periods necessitates certain adjustments.

This annual accounting period imitates a basic 12-month calendar period. The period assumption allows stakeholders to make timely business decisions by providing them with reliable and relevant financial data. This accounting period is chosen based on the business needs and conditions, which may be too complicated to warrant other accounting periods.

4–5 Calendar Year

In order to report the performance of the business to outsiders, one year is the usual accounting period. Accounting TransactionsAccounting Transactions are business activities which have a direct monetary effect on the finances of a Company. For example, Apple representing nearly $200 billion in cash & cash equivalents in its balance sheet is an accounting transaction.

Now suppose, he takes away Rs. 5000 cash or goods for the same worth for his domestic purposes. This withdrawal of cash/goods by the owner from the business is his private expense and not the business expense. This term is essential to investors because it allows them to compare trends in financial results over time.

Sorry, the comment form is closed at this time.